The Most Powerful White Label Website Builder

With Offsprout’s White Label Website Builder for WordPress, you spend less time building websites and more time building your business.

Create Websites in Just 5 Minutes

Focus on capturing more clients by eliminating the repetitive work of building new client sites.

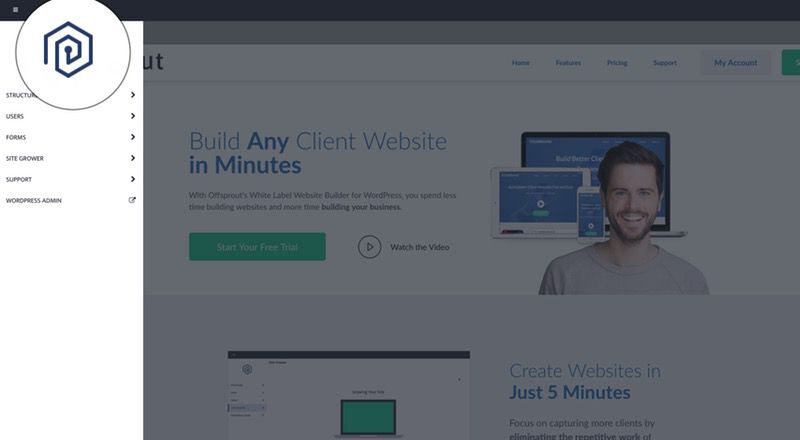

White Label Web Design Experience

We don’t want to come between you and your business. That’s why Offsprout comes completely unbranded. From the design interface to the help files.

Add your logo to the Offsprout’s design interface.

Tools to Create

Your client wants something specific? Not a problem. Choose from over 35 design elements.

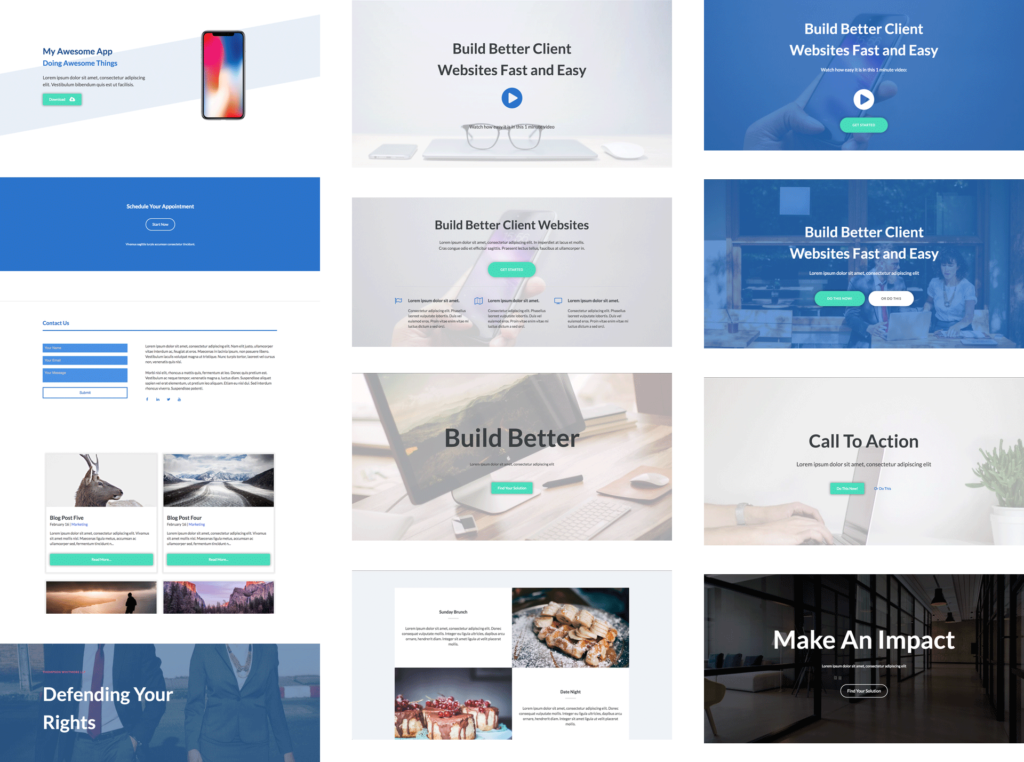

Pre-built Templates for a Quick Start

Choose from over 40 page templates and over 100 section templates. Customize to your client’s specs or even start with a blank slate.

Save Time. Maximize Profits.

Centralized color schemes, fonts, templates, button designs, and more enable incredibly fast website builds and management.

Offsprout brings Wix-style editing to WordPress.

Micah Wood

WPScholar

Offsprout is just plain awesome. Clean, easy, nice.

Jessica Donakowski

Web Designer

Offsprout is insanely quick and responsive.

Ruben Kalath

Sideways8

Free 14-day trial. Easy setup. Cancel any time.

plans starting at only $9/month

FAQ

What is Offsprout?

Offsprout is a WordPress solution comprised of the free Offsprout Page Builder WordPress plugin, Offsprout Pro, a premium WordPress plugin, and Offsprout Theme, a WordPress theme.

How do I use Offsprout?

Offsprout can be installed on any WordPress site. Here’s an article that describes how to install Offsprout.

How many sites can I use Offsprout on?

That depends on your license. You can choose between a 3-site, 10-site, or unlimited license!

What is your refund policy?

We offer a 60-day money-back guarantee on all annual subscriptions. Monthly subscriptions are non-refundable, but can be cancelled at any time.

Can I build my own Offsprout modules?

Yes! Offsprout is written in React, so familiarity with React will help, however we will soon have documentation that will make it easy to extend Offsprout even if you have no prior React experience!

Is Offsprout Multisite Compatible?

Yes, Offsprout can be activated on a site-by-site basis in WordPress multisite.

Can I build my entire site with Offsprout?

Yes! With the Offsprout Theme, you are able to design every aspect of your site with the Offsprout builder. That means headers, footers, sidebars, and whatever else you can think of!

Does Offsprout work with all other WordPress plugins?

There are currently no known incompatibilities with other WordPress plugins. If you find one, be sure to let us know!

Will you be adding more module types and features?

Yes, we have a lot of awesome new stuff on our roadmap. And we would love to hear what features you’d like to see built next, so email us!

What happens after my free trial?

You will automatically be billed at the monthly rate that you chose when signing up.

Is Offsprout truly a white label website builder?

Yes, it is! Offsprout comes completely unbranded out of the box. Even our help and support files are unbranded.

Where can I get support?

To get support, visit our support page.

Resources

Comparisons

Solutions

Products

Features

About Offsprout

Offsprout was founded by two former college freshman roommates. Drawing from their experience building their web design business, JurisPage, which was acquired in 2016, Offsprout is singularly focused on being the best white label website building tool for web design businesses.